Understanding Health Disparities and the Role of Community Health Initiatives

Health disparities remain a significant challenge in achieving equitable wellness outcomes. This article explores the impact of social determinants of health, the importance of community health programs, and practical mental health exercises to support overall well-being.

What Are Health Disparities?

Health disparities refer to the differences in health outcomes and access to healthcare services among various population groups. These differences often stem from social determinants of health such as economic status, education, environment, and access to care. Recognizing these disparities is critical in developing effective strategies to improve health equity.

The Impact of Social Determinants of Health

Social determinants of health heavily influence community and individual well-being. Factors such as housing stability, employment, transportation, and food security can affect one's ability to maintain good health. For example, neighborhoods with limited access to health care providers or nutritious food options often experience higher rates of chronic illnesses.

Community health organizations like Community Health Choice and Legacy Community Health work towards mitigating these challenges by offering tailored services and support to vulnerable populations.

Role of Community Health Programs

Community health centers are at the forefront of tackling health disparities. By providing affordable, accessible health services, these centers help bridge gaps in care. Programs offered by organizations such as Oak Street Health and Trinity Health MyChart empower patients to manage their health effectively through patient portals and personalized care plans.

Many centers also address behavioral health needs, recognizing that mental health is a fundamental component of overall wellness. Initiatives from providers like Lifestance Health and Spring Health emphasize the importance of mental health awareness and offer treatment options that reduce stigma and improve access.

Benefits of Home Health Aides

Home health aides play a vital role in supporting individuals with chronic conditions or disabilities, enabling them to receive care within the comfort of their homes. This approach not only improves quality of life but also reduces hospital readmissions and healthcare costs.

Mental Health Exercises to Support Wellness

Incorporating mental health exercises into daily routines can significantly enhance emotional resilience and reduce stress. Some effective techniques include:

- Mindfulness Meditation: Focusing on the present moment to increase awareness and reduce anxiety.

- Breathing Exercises: Simple deep breathing techniques to calm the nervous system.

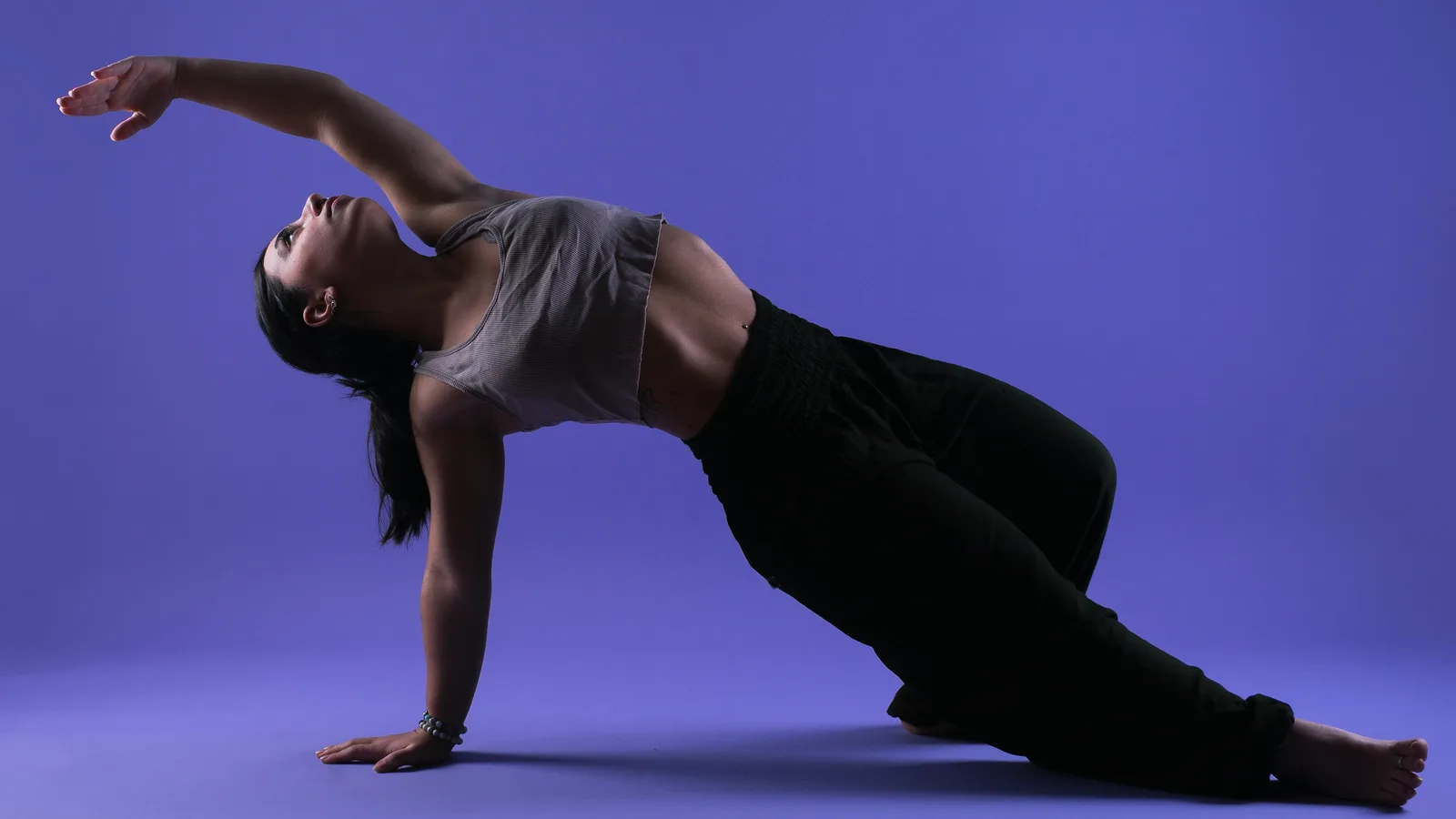

- Physical Activity: Regular exercise promotes the release of endorphins, improving mood.

- Journaling: Writing down thoughts and feelings helps process emotions and track progress.

These methods are often recommended by behavioral health specialists and supported by platforms like Lyra Health and Brightside Health.

Utilizing Technology for Health Management

Advances in digital health have made managing wellness more accessible than ever. Patient portals such as MyChart Ohio Health, Novant Health MyChart, and Atrium Health Login allow users to view test results, schedule appointments, and communicate with their healthcare providers seamlessly.

Additionally, platforms like Athena Health Login and United Health Care Provider Portal streamline administrative tasks, improving the overall patient experience. These tools empower individuals to take charge of their health care, fostering better outcomes.

Conclusion

Addressing health disparities requires a multifaceted approach that encompasses understanding social determinants, enhancing community health programs, supporting mental wellness, and embracing technology. By working together, healthcare providers, community organizations, and individuals can create more equitable health outcomes and promote lasting wellness for all.